Big geospatial human mobility data and analytics offer unprecedented possibilities to explore, visualise, model, and understand retail in new ways. In this post, we will try to answer the questions formulated above and discover how big data on human mobility can reveal spatial patterns leading to insights that not only add enormous business value to our clients but facilitate the formulation of hypotheses about the nature of retail in cities.

We will use PerigonAI's Big Data lake and analytic engines to analyse urban mobility related to shopping malls in the two largest cities in Saudi Arabia: Riyadh and Jeddah. In our previous post, we already saw how the mobility patterns of different age and gender groups can differ in interesting ways. Now, let's start by looking at an interesting measure of how the population interacts with retail: how much time do people spend in malls?

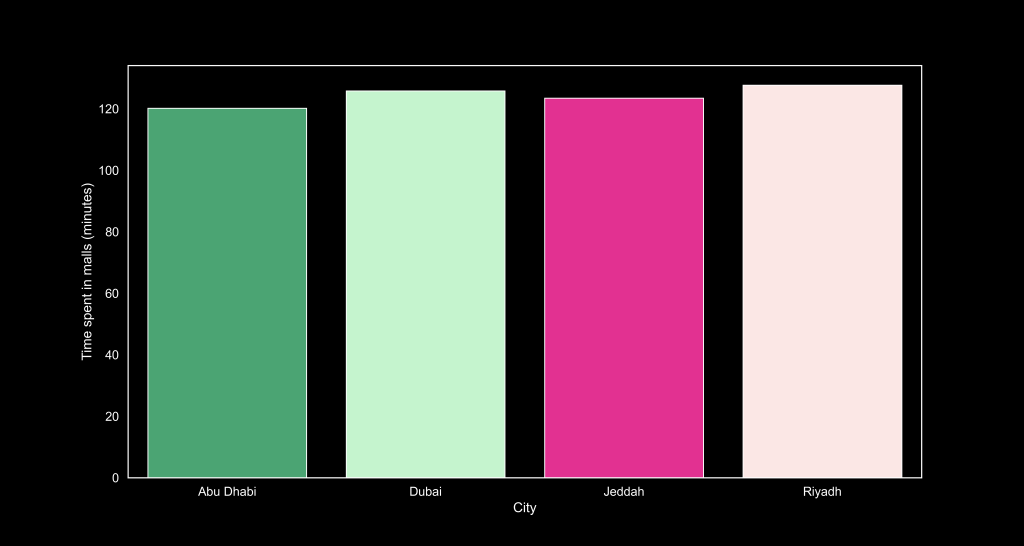

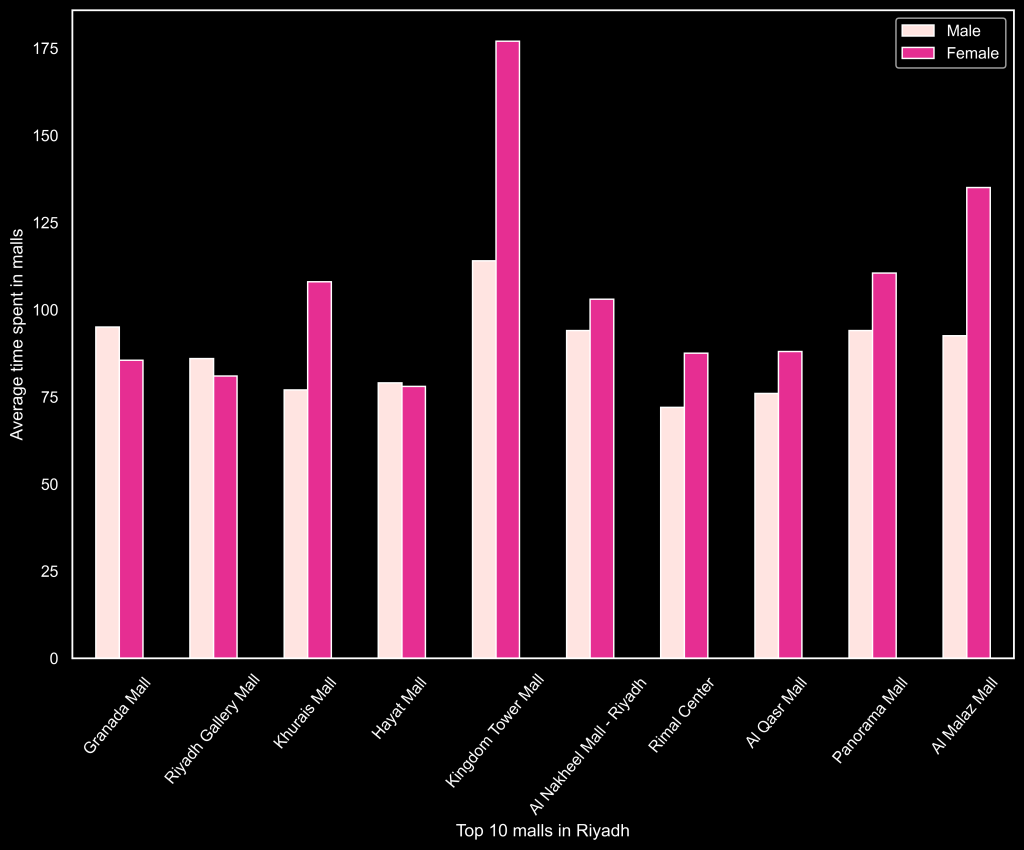

While we shall compare Saudi Arabia with the UAE in an upcoming post, we show in the above bar chart the average time spent in malls in Abu Dhabi, Dubai, Jeddah, and Riyadh. As we can see, the average time spent in malls is roughly centered at 2 hours, with Dubai and Riyadh displaying slightly higher numbers. Such an aggregate measure of commercial dwell time is undoubtedly interesting in and of itself, but the real power of big human mobility data lies in exploring it across different demographic, spatial, and temporal dimensions. Let's look at the commercial dwell time in Riyadh across the 10 major shopping malls (as calculated by the number of visitors throughout the year) for men and women:

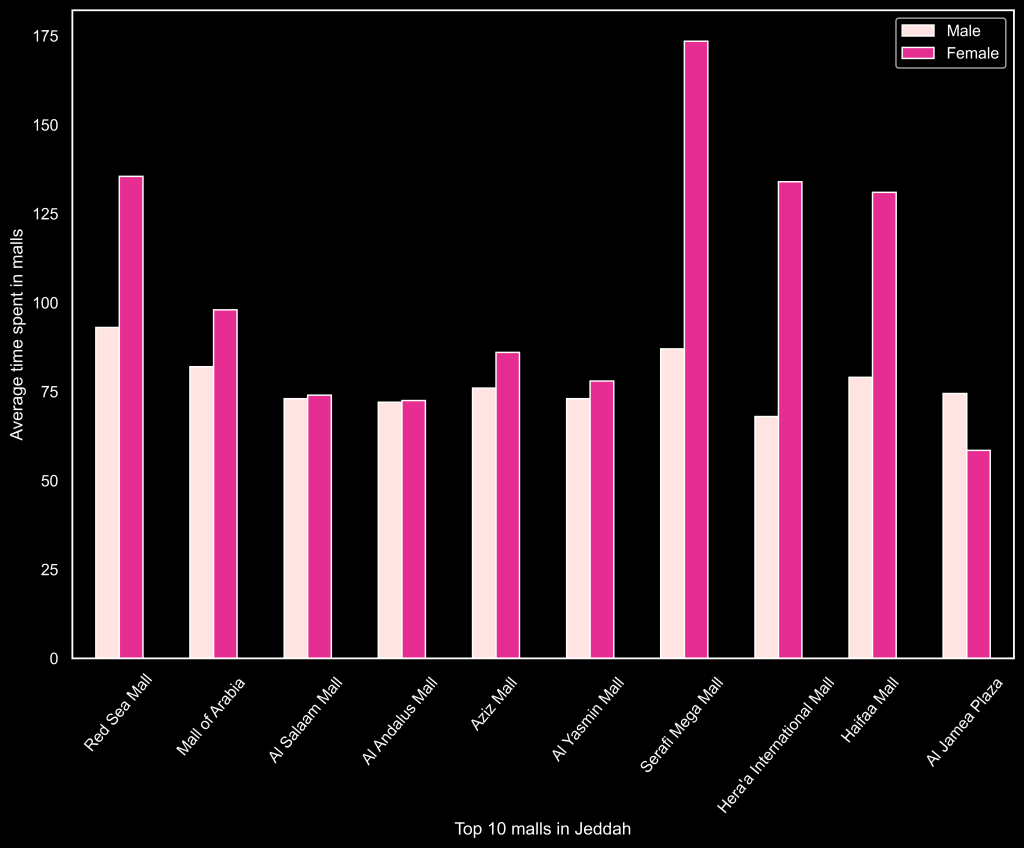

The first thing that strikes the eye is that women spend more time in most of the shopping malls than men do. This difference is especially apparent in Khurais Mall, Kingdom Tower Mall, and Al Malaz Mall. Looking at the same breakdown across malls in Jeddah, we discover a similar pattern, with Serafi Mega Mall, Hera'a International Mall, and Haifaa Mall displaying a strong difference between men and women in average commercial time spent in the mall.

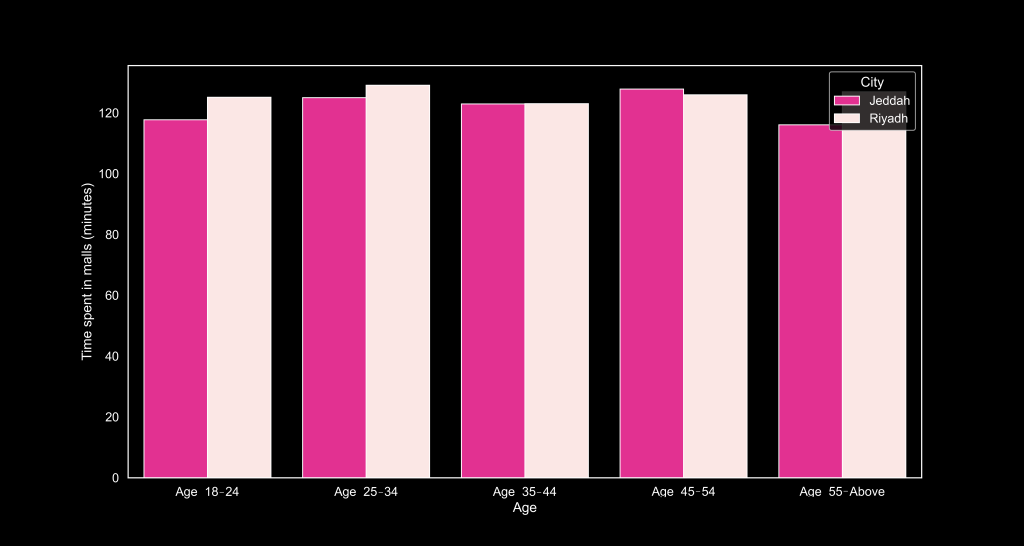

Looking at the same data from yet another angle, across different age categories in Riyadh and Jeddah, we discover that people in Riyadh spend more time in malls across all age brackets except for people aged between 45 and 54 years.

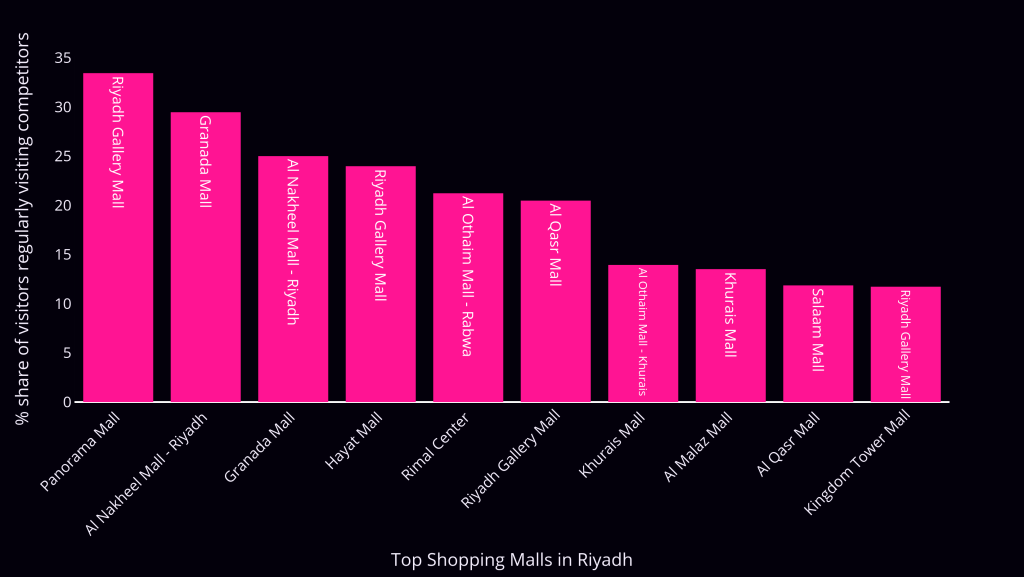

Let's now investigate another interesting question: what does the competition look like for different shopping malls? In order to measure competition, we first need to define it. We define competition as other shopping malls that the visitors of a given mall visit on a regular basis.

For each individual shopping mall, we measure this by computing the percentage share of regular visitors to that mall that also visit other shopping malls on a regular basis, and by determining the major competitor for that mall. Let's see what this looks like for the shopping malls in Riyadh:

In the bar chart above, shopping malls in Riyadh are ranked according to the share of regular visitors that also visit other malls on a regular basis, in descending order. Each bar representing a given mall is annotated at the top with the name of its major competitor mall, i.e., the mall to which the visitors of a mall visit the most. For instance, we see that Riyadh Gallery Mall has circa 32% of its visitors regularly visiting other malls, with Hayat Mall, its major competitor mall, receiving most of them.

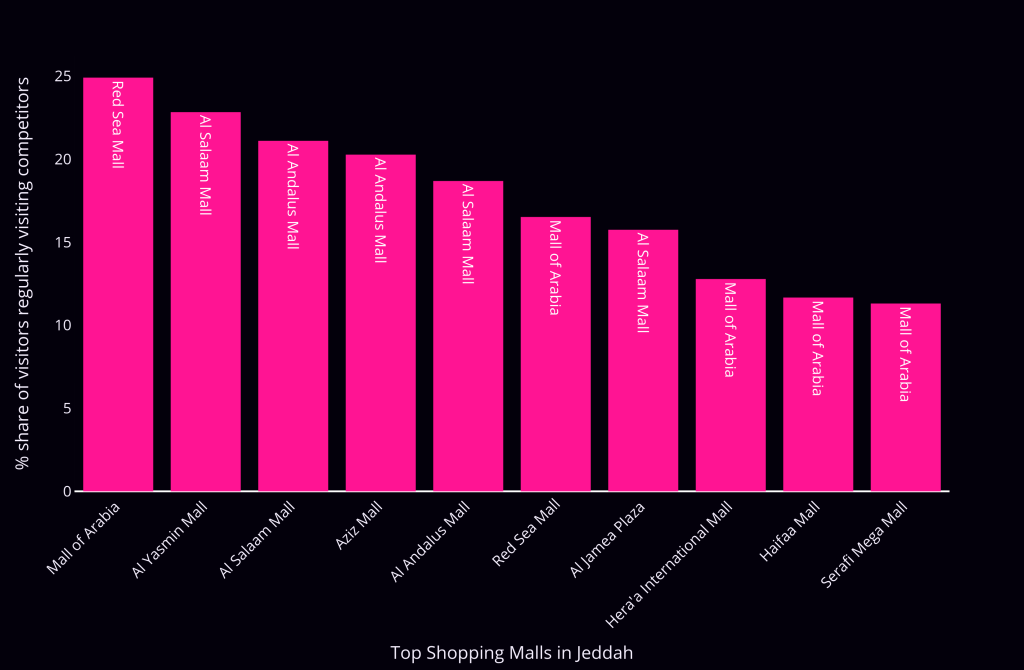

Similarly, let's take a look at what shopping mall competition looks like in Jeddah:

We first notice that the share of churning (used loosely here) shopping mall visitors is considerably less among the first few malls in Jeddah compared to Riyadh. As in the previous bar chart, we can see the major competitor mall for each shopping mall, annotated at the top of the bars.

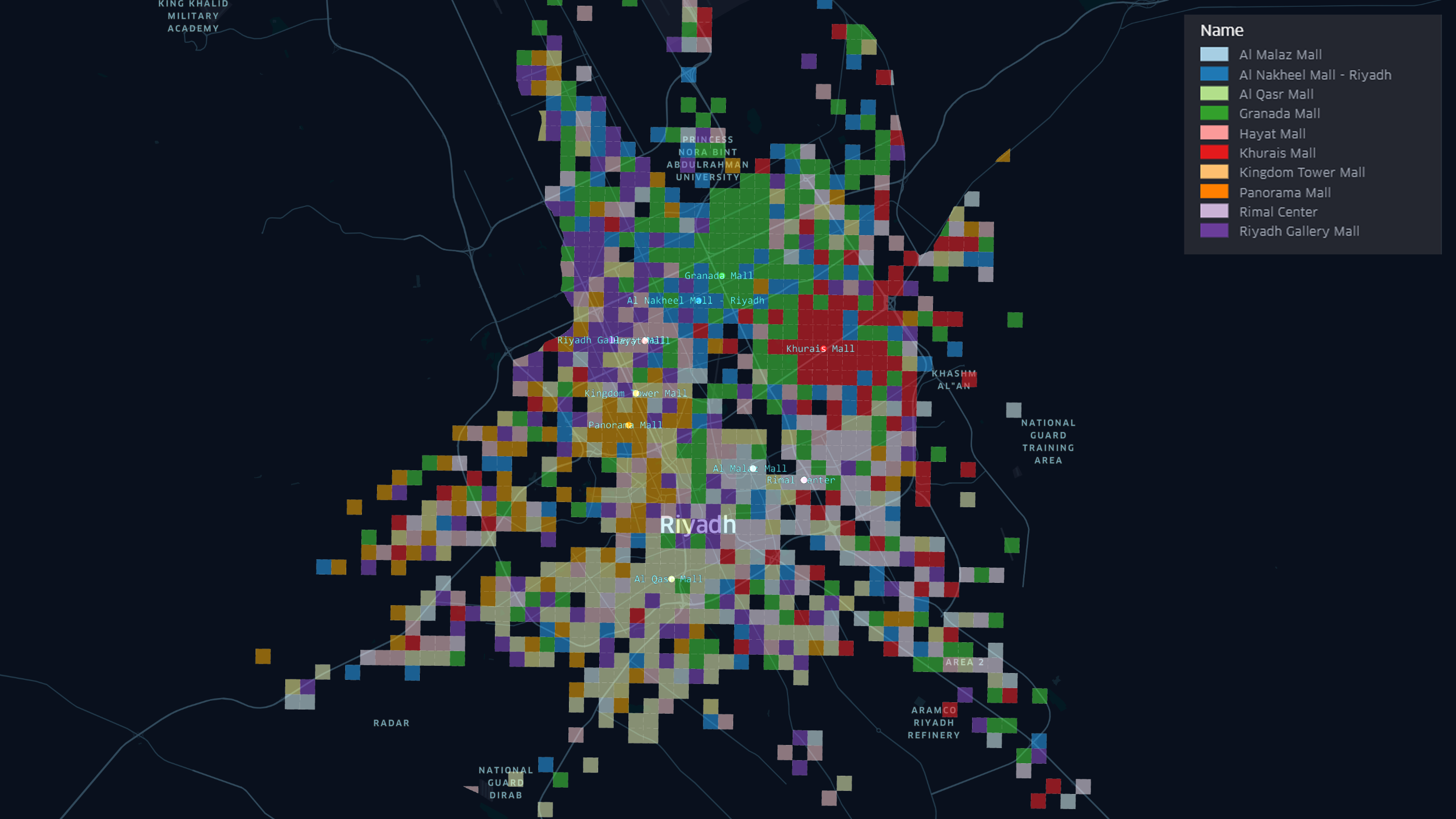

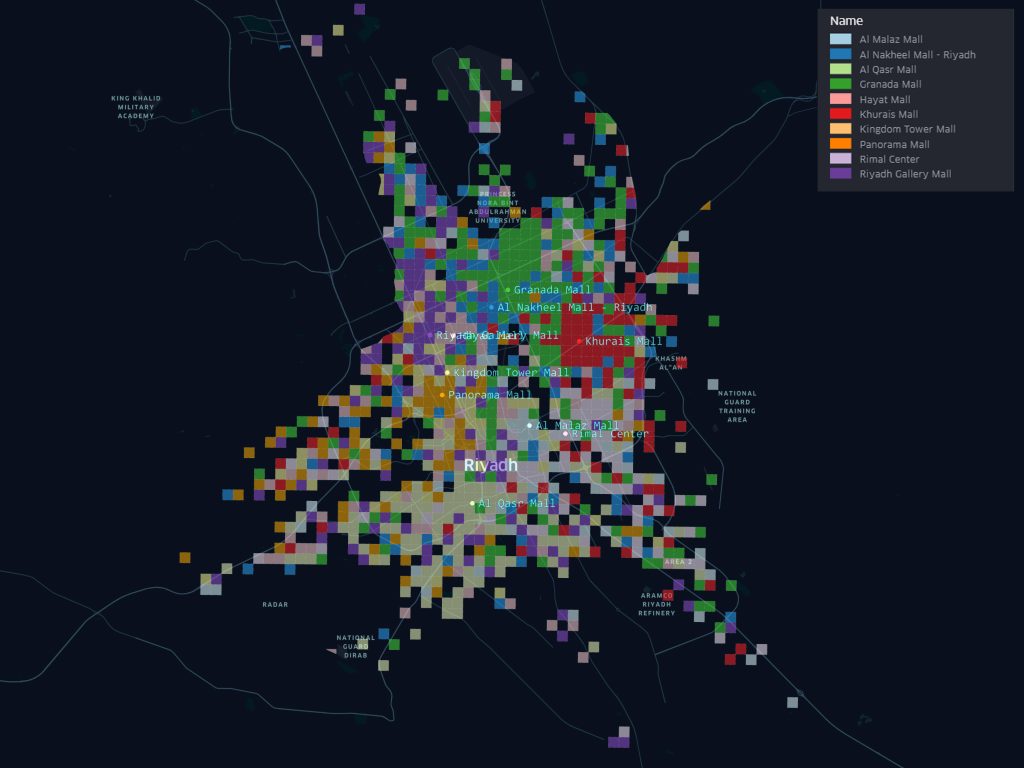

Finally, let's not forget that one of the most important dimensions in understanding retail is the spatial dimension. If we visualise the customer base of different shopping malls on a map, we will see more or less clear trade areas which shopping malls draw their customers from. Let's see this in action in the case of Riyadh:

This offers us the possibility to understand the geographic structure of the shopping mall trade areas. We see, for instance, that shopping malls such as Granada Mall (dark green), Khurais Mall (red), and Al Qasr Mall (light green) have spatially clustered trade areas with relatively clear boundaries, while other malls, such as Riyadh Gallery Mall (purple) or Al Nakheel Mall (blue) have more spread out trade areas, dispersed across the city. Northeast of Riyadh shows a greater preference for Granada Mall; the sought after North of Riyadh has no clear mall preference despite being predominantly divided between Granada Mall and the Riyadh Galleria Mall; Khurais Mall seems to mostly attract visitors from its surroundings as mentioned above, East of Riyadh; The southeast of the city seems predominantly covered by visitors to Al Qasr Mall.

This post was meant as a first glimpse into how big geospatial human mobility data can reveal new perspectives on urban retail. In an upcoming post, we will take a closer look at the relationship between urban mobility and retail in different countries across different continents.